The February 2021 Gas contract rose 8.9% last week, following mounting concerns of a potential strike at EDF’s French Power plants that would likely increase gas-for-power demand to fill the gap, contributing to a tighter supply outlook. In addition, colder temperatures led to an increase in demand for gas to be used in heating, leaving the UK gas system around 10 mcm/d undersupplied.

The February 2021 Power contract increased 5.7% tracking increases in UK gas, as well as European carbon and coal, while French nuclear outages remain a concern for their potential effect on power output.

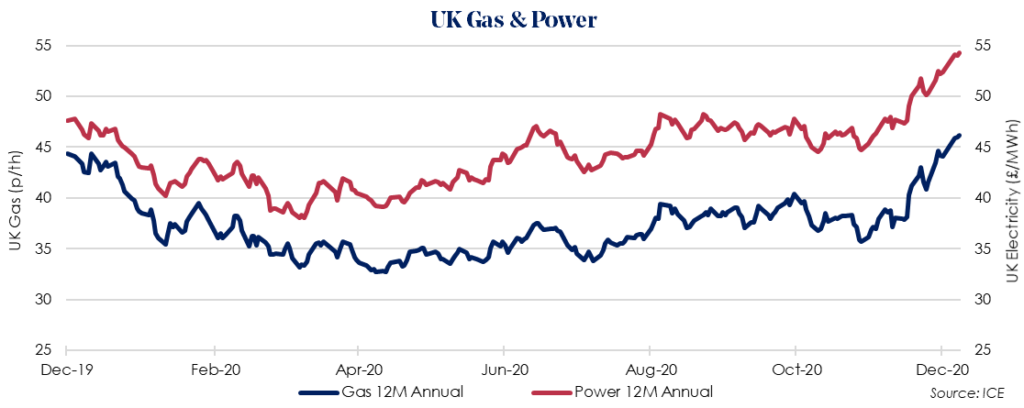

The forward April 2021 12 Month Gas price rose by 4.7% last week. Price rises were driven expectations of higher energy demand and rising European coal prices. High demand for LNG in Asia is also forecast to draw a significant share of LNG from Europe, creating a tightness in European markets.

The April 2021 12 Month Power price rose 4.8% last week, tracking significant gains in gas.

The significant price gains in both UK Gas and Power follow news that the UK has approved the Oxford University/AstraZeneca Covid-19 vaccine. Hospitals have been receiving batches of the new vaccine in preparation for its rollout starting on Monday 4 January. It represents a major boost for economic and energy demand forecasts for next year.

European carbon rose 1.7% last week, hitting €32.57 after the UK and EU secured a trade deal in which both parties formally committed to giving “serious” consideration to linking their emissions trading system. The deal also ensures both sides remain committed to the Paris climate agreement, including renewables targets.

Pound Sterling rose 0.9% in value against US Dollars, ending 2020 at its highest point all year, after the UK secured a comprehensive trade deal with the EU after years of uncertainty. The gains mean the Pound Sterling, which has been constantly buffeted by concerns over the UK’s withdrawal from the EU since the June 2016 referendum, has gained about 3% against the US dollar this year.