The Sept 2021 Gas price jumped 15.3% to 103.75p/therm last week, as lower supply due to outages coincided with strong demand from gas-fired power plants amid low output from the UK’s nuclear plants.

Seven of Britain’s 13 operating nuclear units are currently offline reducing nuclear output by 4.2GW.

Norwegian flows are reduced due to maintenance at the Troll gas field and UK Continental Shelf production is also impacted by unplanned outages at Bacton Perenco and lower flows from Bacton SEAL terminal.

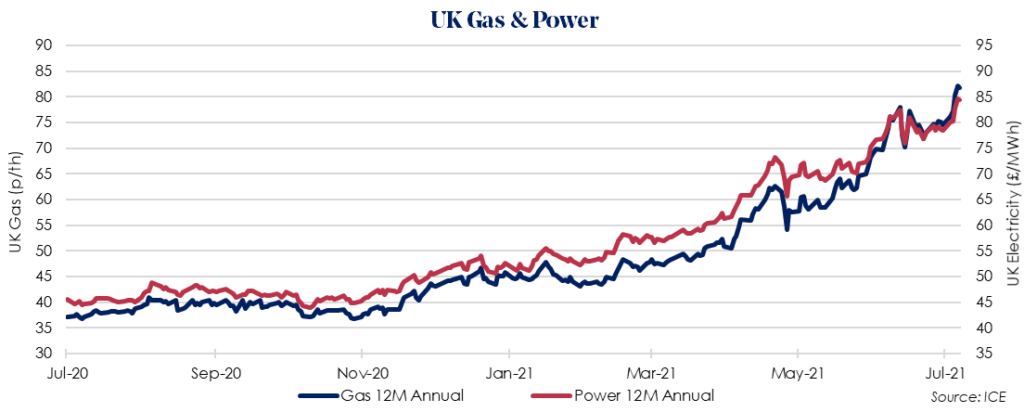

The Oct 2021 12 Month Gas price increased 9.9% to 81.87p/therm as concerns over winter supply continued to mount. European gas storages are still only 57% full. This continues to be the largest supply risk ahead of the colder winter period.

Meanwhile a lack of arrivals of LNG tankers also helped to boost curve contracts, with no tankers currently scheduled to arrive in Britain.

The Oct 2021 12 Month Power price rose 7.7% to £84.47/MWh, tracking gas prices higher with gains in oil, carbon and coal providing further support.

Prices for both gas and power continue to be supported by high levels of tender activity in the run up to the 1 Oct renewal date.

The months of July, Aug and Sept are the busiest in the industry, meaning any clients who haven’t yet secured their new contracts will all be asking suppliers for prices at the same time, supporting high prices.