The UK’s Day-Ahead gas rose by 43.5% to 26.90/therm as supply took a significant hit during various UK and Norwegian gas maintenance works. This compounded the effect of increased heating demand with the coldest August Bank Holiday in 50 years.

Day-Ahead power saw a significant rise of 21.3% to £35.89/MWh as gas-for-power supply and renewable generation availability dropped.

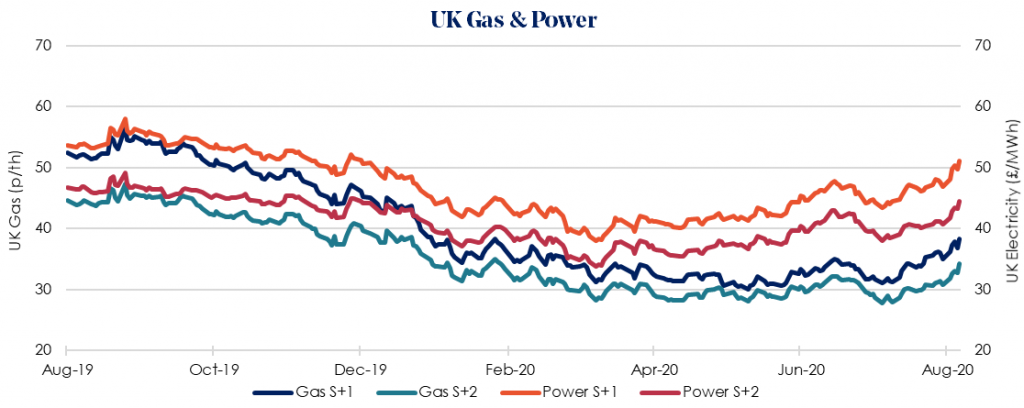

Winter 2020/21 power prices saw a rise of 8.9% to £51.07/MWh. These price rises follow the 15.1% rise seen in European carbon with outages at three French nuclear reactors increasing the demand for coal and gas-fired generation on the Continent. These factors bolstered the effect of reduced volumes of carbon credits available to auction due to the UK bank holiday.

Winter 2020/21 gas also rose 9.2% to 38.22p/therm due to significantly reduced UK gas production alongside heavy maintenances following two weeks of Norwegian disruptions.

Two shipments of LNG are set to arrive in the UK this week from Qatar, continuing to supplement reduced pipe flows. LNG prices remain low as the supply continues to outweigh demand. European LNG shipment rose by 11% this week despite concerns that US LNG exports would be slashed.

At present, our recommendation for clients with open Winter volume remains to lock this in soon. For those with greater risk appetite, holding off a week, until after the next round of carbon auctions, may see some drops in price as the current bullish market appears speculative.