The April 2021 Gas contract fell a further 3.5% last week. Strong LNG supply is easing concerns of supply issues extending into April. Prices may have fallen further; however unplanned maintenance has halted all production from Norway’s Skarv gas field this week.

Prime Minister Boris Johnson’s announcement that lockdown conditions will exist, in diminishing states, until at least the 21st of June 2021, has solidified that no significant demand spikes are likely to be seen in April, also weighing down on price forecasts.

The April 2021 Power contract also continued to fall, by 2.2%, largely in line with changes seen in gas and lower demand forecasts in April.

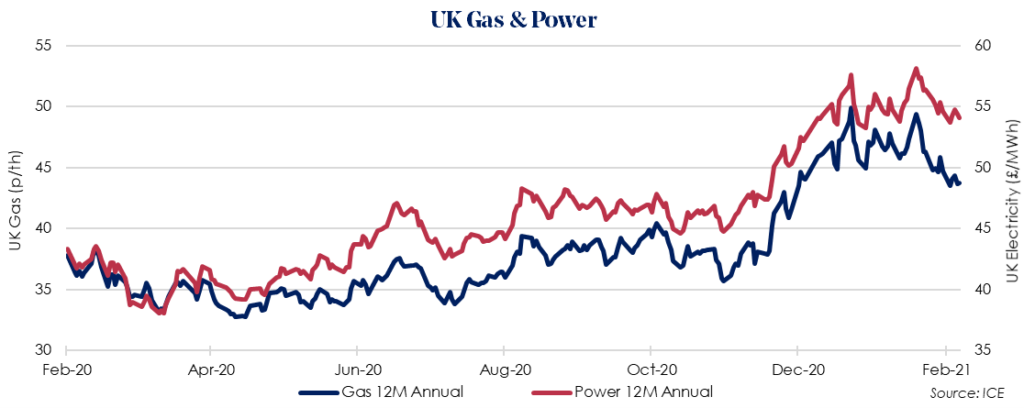

The April 2021 12 Month Gas price fell by 2.3%, as optimism grows that the worst of winter weather may have passed, and gas supply will now last, undisturbed, into the summer months. European gas storage has continued to decline to 37%, however the rate of extraction has eased compared against previous years, helping drive the reduction in prices.

The UK continues to secure a strong LNG supply this week with a further 11 shipments scheduled, which should sustain demand until temperatures rise during March.

The April 2021 12 Month Power price fell by 0.9%, largely due to near-term confirmation that lockdown conditions will last until at least the end of Q2-2021. Power prices do however remain relatively high due to the rising cost of EU carbon credits.