The July 2021 Gas price was broadly unchanged at 60.68p/therm last week as the market continued to stabilise after a period of intense volatility. However, we could be in store for slightly lower prices as warmer weather and stronger wind lower demand, while lower carbon prices also weighed on energy markets.

Gas for power generation could fall to 40 mcm/d this week compared to 55 mcm/d last week, amid stronger renewable generation.

The June 2021 Power price saw a small increase of 1.0% to £73.94/MWh, as gains in the coal market were more significant than the modest carbon’s decline. UK power prices continue to be largely led by Continental European power prices where coal remains a significant source of power generation.

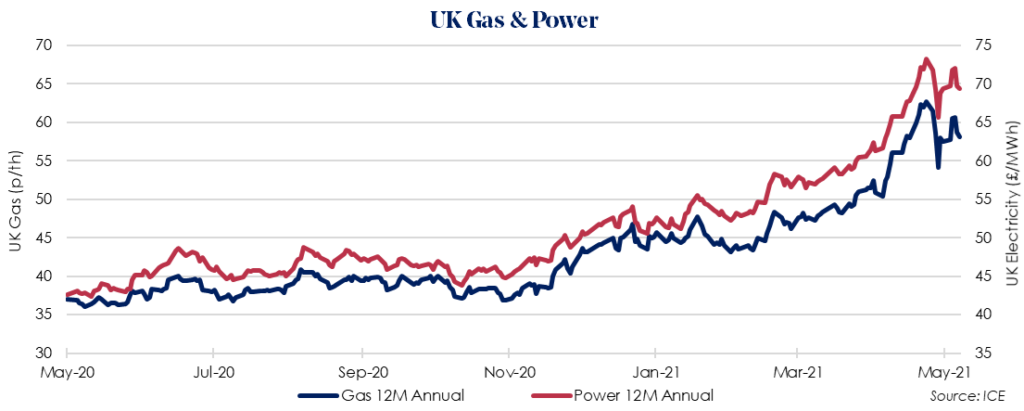

The Oct 2021 12 Month Gas price rose 1.0% to 58.08p/therm. This is driven by a lack of LNG imports and disruptions to Norwegian pipeline flows, which resulted in weaker supply. UK gas storage remains extremely low at just 8% full, compared to 65% this time last year. Meanwhile EU gas storage still only sits at 37%.

The Oct 2021 12 Month Power price also saw a small decline of 0.1% to £69.37/MWh, as carbon prices recorded a modest drop.

Carbon remains a key price drivers for UK power with any significant movement is likely to be critical for the direction of UK energy prices.