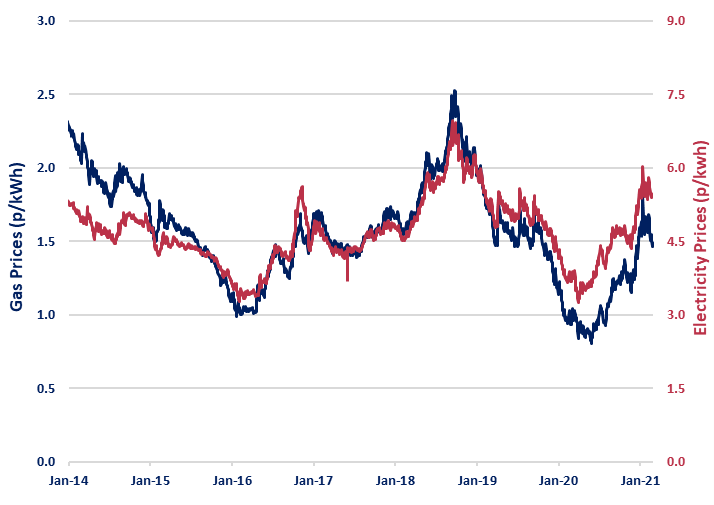

UK gas prices posted losses during February. Gas prices fell 11.3% to 1.47 p/kWh reflecting a general increase in European temperatures as well as an improved expectation for LNG shipments to Europe. The increase in gas imports into Britain is enabling injection into UK gas storage and reducing the outlook for long term energy prices.

Power prices also recorded a small drop last month, falling 4.6% to 5.38 p/kWh, tracking the dip in gas in response to milder temperatures and forecasts for reduced energy demand. Gains in carbon limited losses.

Carbon recorded a 12.8% increase in European prices to €38.20/tCO2, in anticipation of the EU’s European Energy Deal aimed at accelerating the path to net zero, which could result in higher carbon taxes. Brent crude oil prices moved 20.4% higher to $66.88/bbl, setting a new 13-month high due to continued production cuts by OPEC and Russia. Saudi Arabia has made a voluntary cut of 1 million bpd to the end of March.

With 1 April only 4 weeks away, there isn’t much time to secure energy contracts renewing for this date if clients want to transfer supplier on time. So immediate action should be taken to lock in contracts if this applies to you.

For later renewals, such as Oct 2021 and 2022, prices are beginning to decline. Prices may hit their lowest point around May-July. Clients should already be discussing their renewal with their account manager, with a view to scheduling auctions for spring or summer 2021.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.