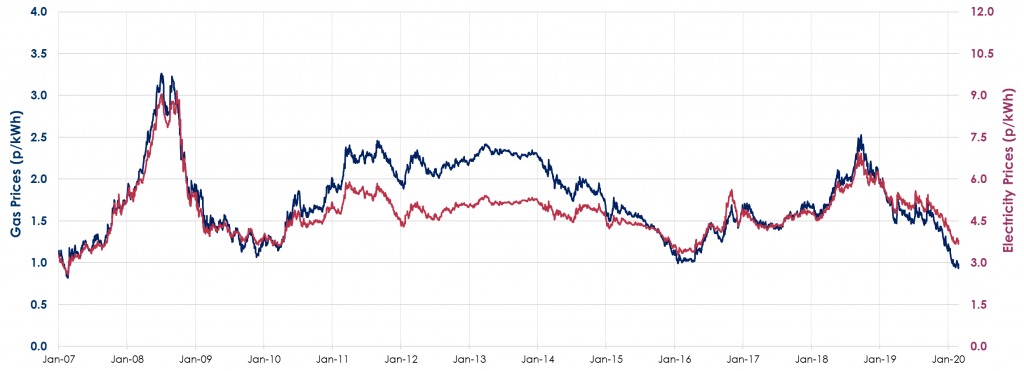

UK gas and power prices posted losses during May. Gas prices fell 9.5% to 0.81 p/kWh as warmer weather boosted renewable solar and wind generation, while also reducing power demand. Stable pipeline flows and LNG deliveries continued to supplement injections into gas storage, which was already 12% higher than it was at the same point last year. Gas stockpiles in Europe have increased to 72% of capacity, compared to 60% at the same point in 2019, meaning that less storage capacity needs to be refilled during the summer gas injection season.

Power also fell last month, losing 0.3% to 3.57 p/kWh. However, the increase in carbon limited price movement for UK power.

Brent crude oil prices jumped 39.7% higher during May to $35.29/bbl as several countries across Europe, including the UK, initiated plans to gradually ease the Covid-19 lockdown.

Carbon increased 8.7% to €21.19/tCO2 following plans for lockdown measures to end. An increase in transport use and people returning to work would likely boost power demand, and with it increase consumption of fuels for power generation.

Despite an expected recovery in energy markets, UK gas and power prices remain close to record low levels and so are extremely favourable for clients looking to lock in savings for long-term energy contracts.

The UK and many other European countries have already started to ease lockdown restrictions meaning we could see energy demand increase, boosting prices. The volatile nature of energy markets means businesses should start their energy renewals immediately, and consider locking in longer-term gas and power contracts by the end of June.

Coronavirus (Covid-19): Schools in England began to reopen today as lockdown restrictions have been eased across the UK.

The UK’s Covid-19 furlough scheme will also finish at the end of October, Chancellor Rishi Sunak has confirmed.

Please be aware of government guidance regarding Covid-19: “Stay at home, save lives”.

– stay at home as much as possible

– work from home if you can

– limit contact with other people

– keep your distance if you go out (2 metres apart where possible)

– wash your hands regularly

Please contact your Beond Account Manager if you are at unsure what impact Covid-19 may have on your energy contracts.

Ofgem consults on mandatory Half Hourly Settlement: The UK is rolling out smart meters for all domestic and small business customers. However, the data is only being used to calculate quarterly bills. However, Ofgem would like the industry’s systems to be changed over the next 4 years so that by the end of 2024 all suppliers will be paying their wholesale energy bills based on the half-hourly consumption of all of their customers.

Britain records full coal-free month as National Grid balances high renewables and low demand: Zero carbon records tumbled over the bank holiday weekend, as Britain witness its first ever 30-day period of power generation without using any electricity produced from UK coal-fired power plants.

As recently as 2012, coal provided 40% of Britain’s power output. However, Britain is committed to closing its coal generation by 2025.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.