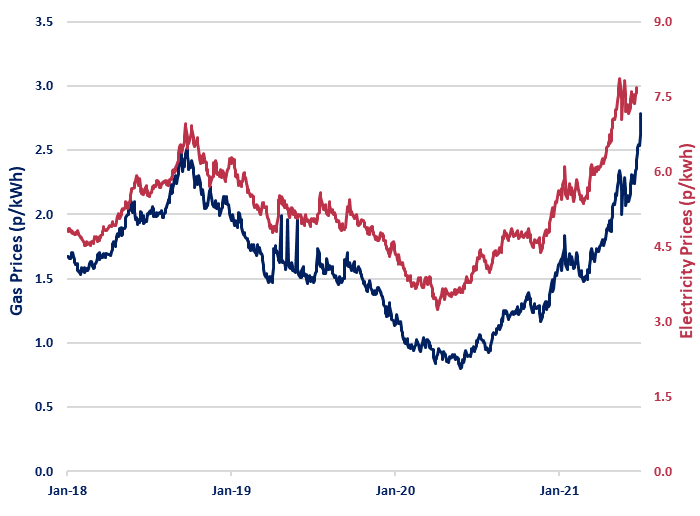

UK gas prices continued to record consistent price gains during June. Gas prices rose a whopping 26.7% to 2.62 p/kWh as low supply from the UK’s LNG terminals and strong demand from the power sector led to an undersupplied market. LNG prices in Asia and Europe have been on the rise as warmer than usual temperatures for this time of year in different parts of the world boosted electricity usage for air conditioning. Additionally, European gas storage levels are still at just 46% of full capacity, well below the 5-year average for June.

Power prices also posted significant gains last month, rising 14.1% to 8.22 p/kWh, tracking gas prices. In related markets, Renewable Energy Guarantee of Origin (REGO) prices have jumped to a premium of c. 0.2 p/kWh, around 50% higher than in January 2021.

Carbon recorded a 9.0% increase in European prices to €55.54/tCO2, as surging gas prices made it more profitable to burn coal. Brent crude oil prices moved 7.4% higher to $74.76/bbl, as the reopening of the global economy from pandemic-enforced lockdowns are seen as bullish for oil demand.

Concerns over EU gas storage and carbon prices means here’s a lot of uncertainty over price movement. However, with just 2-3 months remaining for businesses to lock in their 1 Oct 2021 renewals, the significant increase in tender activity is likely to drive prices higher in the short term.

Clients with 2021 renewals should already be discussing their renewal with their account manager, with a view to scheduling auctions ASAP in July or August. But keep in mind that this period is the busiest tender period for suppliers, so particiation may be impacted.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.