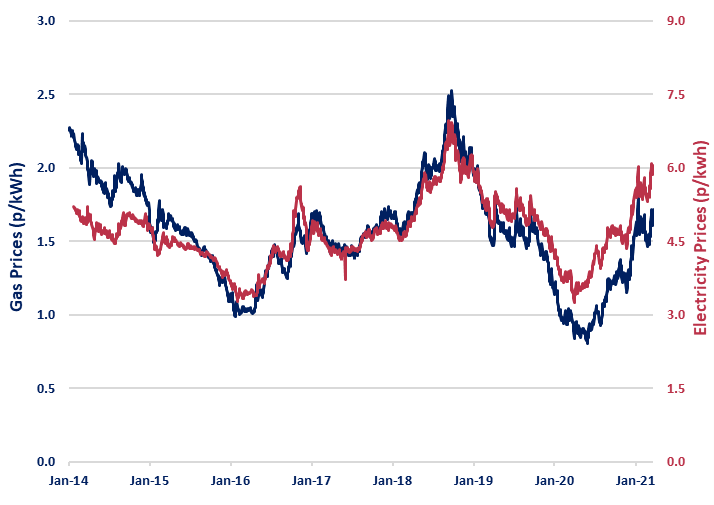

UK gas prices posted significant gains during March. Gas prices rose 15.4% to 1.72 p/kWh after a stranded ship blocked the Suez Canal, halting a huge volume of global shipping traffic. This included Liquefied Natural Gas cargoes, delivering gas to Europe. The container ship was eventually freed after more than a week, but experts think it could take 1-2 weeks to completely clear the backlog.

Power prices also recorded an increase last month, gaining 11.8% to 6.05 p/kWh, tracking the rise in gas in response to the Suez Canal blockage. Prices were also driven by a drop in wind output, while gains in carbon and coal also supported price increases.

European Carbon prices recorded a 12.7% increase to €41.95/tCO2, as uncertainty over the outcome of the ongoing EU climate law talks also fuelled the rise in carbon prices. On the agenda for these talks is enforcing the carbon neutral target by 2050 into EU law. Brent crude oil prices moved 3.0% lower to $64.14/bbl, as demand concerns arose following the news of potential fresh lockdowns in Europe after Covid-19 cases rose for a fourth straight week. Germany and France both look set to extend their respective lockdowns.

Prices remain elevated following the Suez Canal blockage so businesses may prefer to hold off on any renewals for the time being. With temperatures steadily picking up, energy users with Oct 21 renewals should look to lock these away when prices are lower during May-July 21.

For later renewals, including those in 2022, May-July may still be the best opportunity for lower prices. Clients should already be discussing their renewal with their account manager, with a view to scheduling auctions for spring or summer 2021.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.