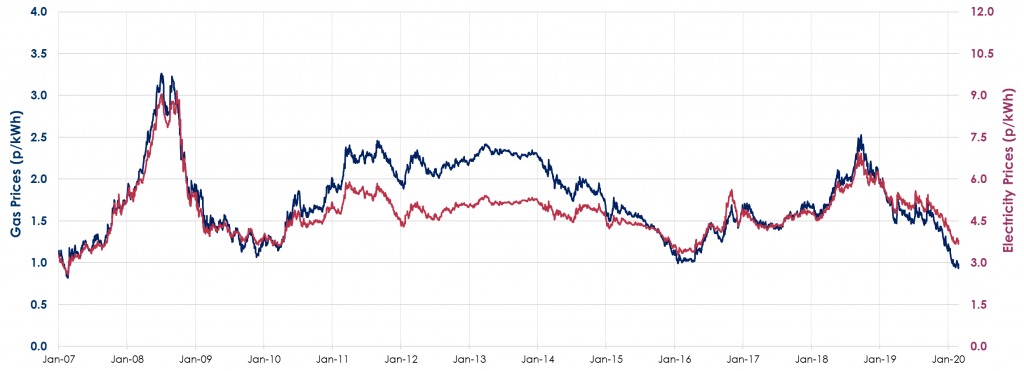

UK gas and power prices posted heavy losses during March. Gas prices fell 13.6%, setting a new 13-year low at 0.88 p/kWh in response to weak global demand in response to many global countries instructing citizens to self isolate. Strong LNG supply, high gas storage, stable pipeline supply and no major outages also helped pull prices lower. Gas stockpiles in Europe are still around 54% of full capacity, compared to just 41% at the same point in 2019, meaning that less storage capacity needs to be refilled during the upcoming summer gas injection season.

Power also fell last month, losing 13.3% to 3.33 p/kWh in response to weaker power demand, gas, carbon and European energy prices.

Brent crude oil prices recorded its worst quarter on record, crashing 54.9% during March to $22.76/bbl, as the Covid-19 pandemic escalated, stiffling global economic and energy demand. Carbon lost 28.2% to €16.93/tCO2 as the global reduction to electricity demand means that emissions will be significantly lower, meaning millions of unused permits could be sold back to the market.

European coal prices also edged lower on concerns coronavirus will further erode global demand and amid low gas prices.

Business shutdowns caused by Covid-19 and comfortable gas supply has resulted in UK gas and power prices crashing further to record low levels. However, global energy prices are unable to significantly further. Combined with post-Brexit uncertainty energy prices for the next 2-3 months should be favourable for multi-year contracts.

It is unclear when coronavirus concerns will come to an end, but the unpredictable nature of energy markets closer to winter means businesses should start their energy renewals immediately, and consider locking in longer-term gas and power contracts by the end of June.

Coronavirus (Covid-19): The UK government is advising those who are at increased risk of severe illness from Covid-19 to be particularly stringent in following social distancing measures.

Please be aware of government guidance regarding Covid-19: “Stay at home, save lives”.

– Only go outside for food, health reasons or work (but only if you cannot work from home)

– If you go out, stay 2 metres away from other people at all times

– Wash your hands as soon as you get home

– Do not meet others, even friends or family. You can spread the virus even if you don’t have symptoms.

Please contact your Beond Account Manager if you are at unsure what impact Covid-19 may have on your energy contracts adn renewals.

Ofgem delaying controversial network charge reform till April 2022: UK energy regulator Ofgem has officially agreed to delay their reform for network charges, called CMP332 Transmission Demand Residual Bandings and Allocation (TCR). The delay means that changes to the existing charging mechanism won’t be made until 1 April 2022, giving stakeholders time to review the impact on consumers, and work out the best way to implement the changes.

Smart meter rollout on hold: Due to Covid-19, UK suppliers have been forced to suspend all non-essential field-based activity in line with the latest guidance from the government. Smart meters will still be installed in emergency or essential situations, for example if there is a fault or loss of supply. Energy suppliers will seek to reduce social interactions with customers in these situations in line with the latest guidance. This hiatus comes as the smart meter rollout was picking up pace, surging 8.2% in Q4 2019 compared to the year before.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.