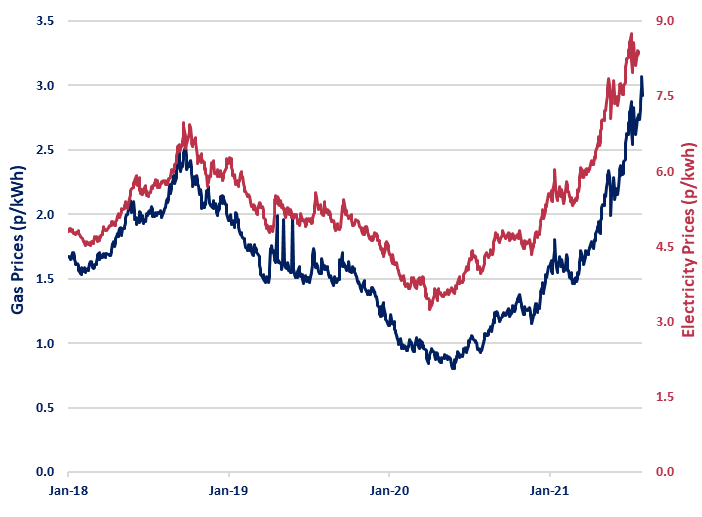

UK gas prices recorded significant price gains during July. Gas prices rose 13.5% to 3.07 p/kWh as lower supply due to outages coincided with strong demand from the gas-fired power plants amid lower output from the UK’s nuclear plants. Norwegian flows are reduced due to maintenance at the Troll gas field. European gas storages are still only 57% full. This continues to be the largest supply risk ahead of the colder winter period.

Power prices also posted significant gains last month, rising 8.3% to 9.08 p/kWh, tracking gas prices. Meanwhile, 7 of Britain’s 13 operating nuclear units are currently offline reducing nuclear output by 4.2GW. In related markets, Renewable Energy Guarantee of Origin (REGO) prices have jumped to a premium of c. 0.23 p/kWh, around 5x higher than in January 2021.

Carbon recorded a 4.0% decline in European prices to €54.00/tCO2, as speculative traders elected to sell, cashing in on profits rather than risking further volatility. Brent crude oil prices moved 1.2% higher to $76.05/bbl, as the reopening of the global economy from pandemic-enforced lockdowns are seen as bullish for oil demand.

Concerns over EU gas storage and carbon prices means here’s a lot of uncertainty over price movement. However, with just 1 month remaining for businesses to lock in their 1 Oct 2021 renewals, the significant increase in tender activity is likely to drive prices higher in the short term.

Clients with 2021 renewals should already be discussing their renewal with their account manager, with a view to scheduling auctions ASAP in August. But keep in mind that this period is the busiest tender period for suppliers, so particiation may be impacted.

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.