The May 2021 Gas price fell 0.7% to 46.86 p/therm last week, with a healthy and consistent LNG supply pushing prices down. LNG send-out looks to have recovered following the clearing of the blockage in the Suez Canal, with 3 deliveries at UK ports on Thursday. Any significant losses were limited by cooler temperatures, providing price support.

The May 2021 Power price climbed 0.7% to £56.64/MWh, lifted by the cooler weather impacting the near-term curve. The near-term curve was also supported by reduced output from renewables, with wind and solar output forecast lower.

Gas and power prices were also supported by Carbon prices, which once again reached record highs last week.

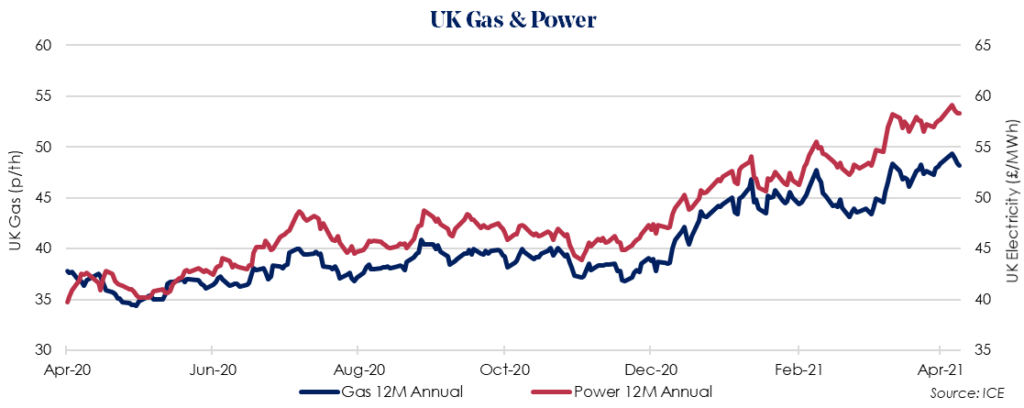

The Oct 2021 12 Month Gas price fell by 0.2% to 48.22p/therm, despite European gas storage falling to just over 30%. UK Gas storage also saw significant withdrawals, falling from 47% on 1st April, to 36% by Friday. Output from the North Sea, which fell by around 50% on Friday due to bad weather delaying maintenance, pushed up day-ahead prices but strong LNG deliveries counteracted this.

The Oct 2021 12 Month Power price rose 1% to £58.33/MWh, buoyed on optimism of future demand recovery. The UK’s Covid vaccine rollout has now seen over 32 million people receive their first dose. This week also marks the easing of lockdown rules in England, with hairdressers, gyms and non-essential retail allowed to reopen.