The March 2021 Gas contract fell a further 6.1% last week as mild temperatures took hold across Europe and are expected at least for the next two weeks, reducing gas demand. Some minor gains were seen towards the end of last week as Norwegian gas exports were reduced following unplanned maintenance restricting supply from the Troll gas field.

The March 2021 Power contract also continued to fall, by a further 5.1%, in line with the milder temperatures and helped in part by falling gas prices, encouraging gas-for-power generation. A fall in the price of carbon also weighed down on the price of March power.

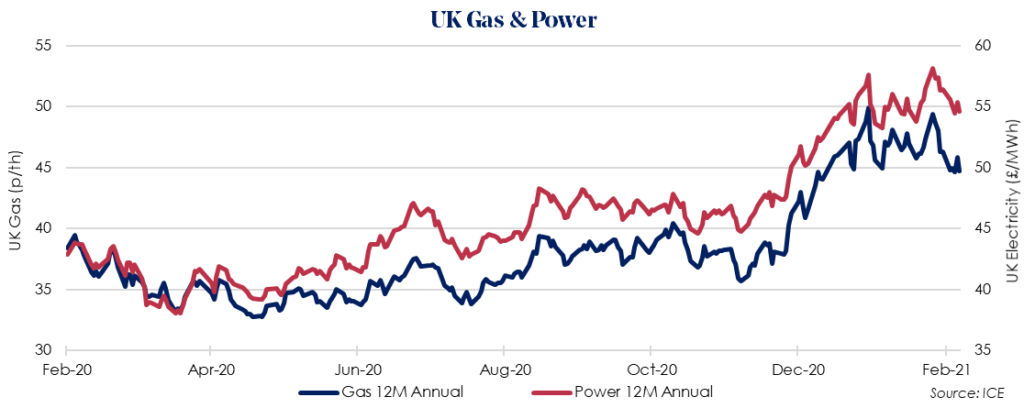

The April 2021 12 Month Gas price fell by 3.4%, as warmer weather and a strong supply of LNG raise optimism. Despite gas storage being very low in Europe, now sitting at 39% of capacity, the warming weather may present a sign that any supply concerns from a long cold winter are easing.

The UK has itself secured a healthy LNG supply over the last several weeks, and this continues with 11 shipments scheduled in the following week. This strong supply of LNG shipments is helped in part by the strength of Pound, which has seen relatively continued growth over the last few weeks, reducing the cost of imports. The UK LNG supply is enabling injection into UK gas storage and improving the outlook for 12M prices.

The April 2021 12 Month Power price fell by 3.2% in line with near-term price drops, predominantly related to the small fall in the price of EU carbon and in line with optimism for UK gas prices over the same period.