The March 2021 Gas contract fell 9.4% last week. Despite a short-term cold weather snap, longer range forecasts indicate the bulk of winter weather and peak gas demand are behind us. Additionally, the UK has secured a strong supply of LNG deliveries, with 8 shipments over the next week, supporting supply.

The March 2021 Power contract fell 4.2%, largely in line with falls in gas prices and improving weather forecasts, despite rises in EU carbon.

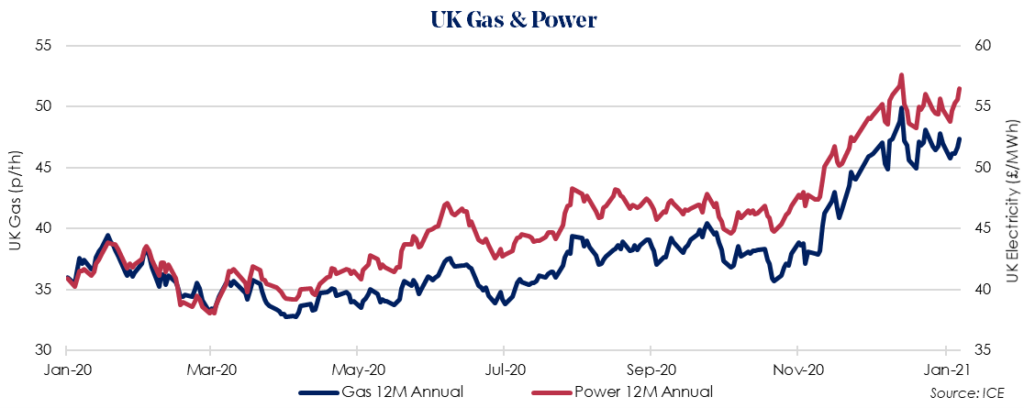

The April 2021 12 Month Gas price saw some small gains of 0.8% last week, as European gas storage continues to fall below 50%, 20 points lower than this time last year.

The main driver of the 12-month gas price is related to carbon seeing a dramatic rise this week, nearly breaching €40/tCO2. The increase, thought to be principally speculative, has driven up longer term gas forecasts despite shorter term price falls.

European gas-fired power generation is likely to become more profitable over more pollutant coal-fired generation, should carbon prices remain high.

Another contributor to the April 2021 12-month gas price is the increases in oil prices, as OPEC+ cuts its production. The increased oil price, alongside forecasts for a weakening US dollar, ahead of President Biden’s US stimulus package, are placing pressure on longer term economic forecasts, driving energy prices up.

The April 2021 12 Month Power price saw a more significant rise of 3.2% last week, with the links between power and carbon prices being more significant.