The UK’s Day-Ahead gas price rose 6.3% to 13.40p/therm as unplanned maintenance at the North Sea Segal pipeline reduced Norwegian flows to the UK by 15 mcm/d.

Day-Ahead power rose 3.6% to £31.02/MWh, as weak renewable generation across impacted on prices. The start of last week saw low solar generation, while wind output fell midweek. Prices rose further as demand for cooling increased towards back end of the week, with the UK experiencing temperatures of up to 37.8C on Friday.

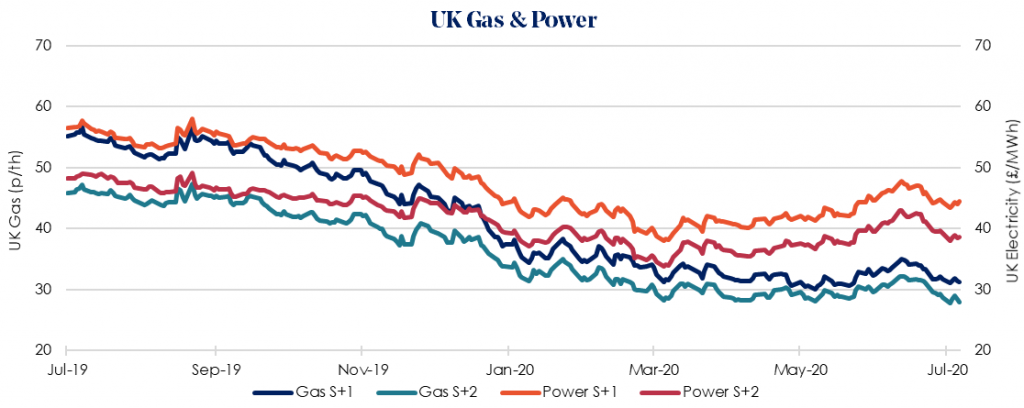

Winter 2020/21 gas fell 1.3% week-on-week to 31.20 p/therm, with the equivalent power price seeing a small rise of 0.3% to £44.42/MWh.

Week-on-week losses were seen across parts of the forward energy market, with Summer 2021 experiencing the biggest losses. This comes as British Prime Minister Boris Johnson delayed the easing of Covid-19 in England as spikes in infections in the UK, Europe and the US have hindered the timeline for of economic recovery. Concerns remain that global fuel demand growth could stall.

Gas storage remains strong at around 88% full, compared to 66% typically seen at this time of year. Meanwhile, two Qatari LNG cargoes are expected to unload this week to supplement UK gas supply.

With the risk of a second wave counteracting the impact of businesses returning to normal, we could see forward energy prices rangebound for the coming weeks. With gas stockpiles so high, it would not be any surprise to see prices peak earlier on in winter. However, we continue to keep an eye open for further shocks to the market.

Our recommendation remains to lock in contracts as soon as possible as prices are at risk of further volatility following the easing of lockdown restrictions.