23 June 2020

The government is gradually allowing businesses to re-open and industrial and commercial activity and energy consumption is starting on the path to returning to normal. Hopefully.

What have we seen in the lock-down? Did we learn any useful lessons?

As organisations were forced to close their doors, we expected to see their electricity use to drop to almost zero. In some cases, we continued to see significant load in empty buildings.

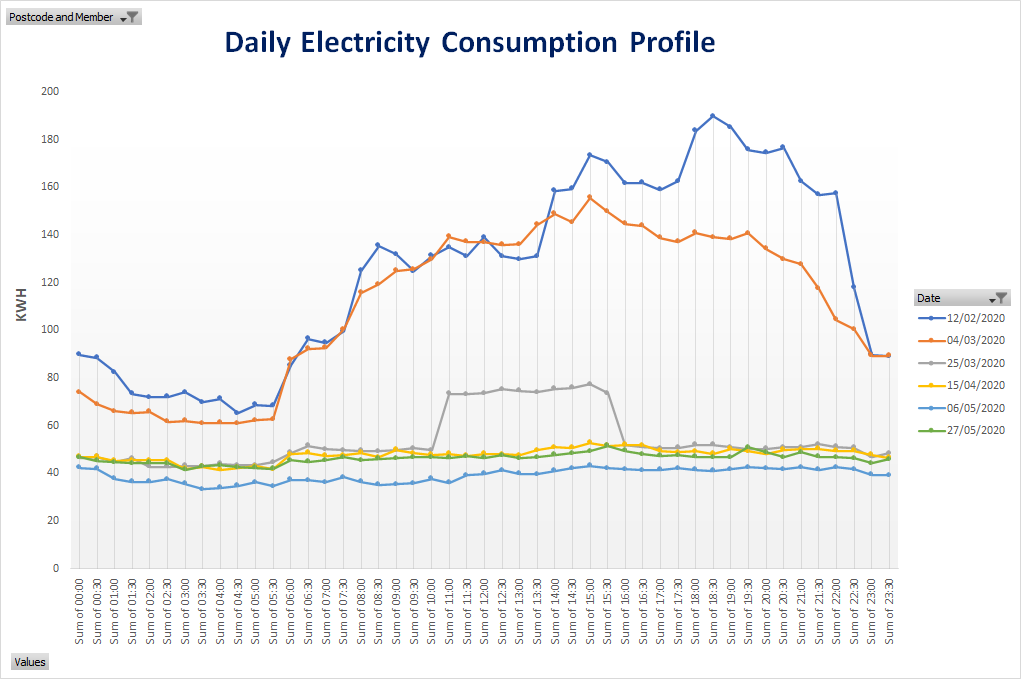

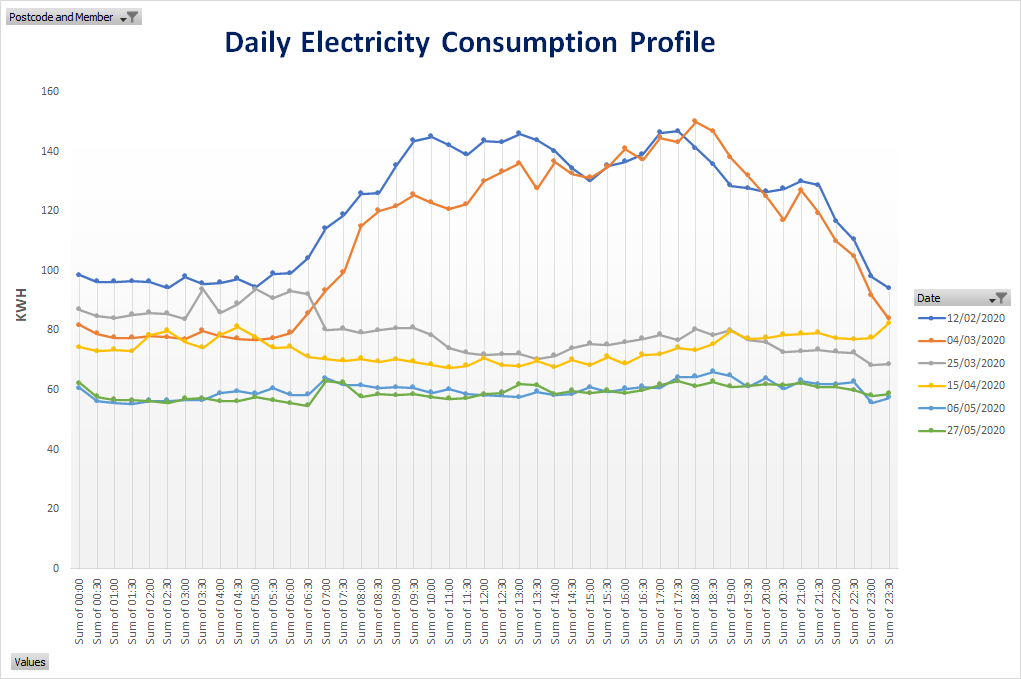

These two charts show similar organisations usage. They compare usage during two Wednesdays prior to lock-down against the lower usage for four Wednesdays after they closed their buildings.

The first example clearly has plant running 24 hours per day before lock-down and also after-lock down. The second example also has plant running 24 hours per day but to a lesser extent. Neither organisation is operating at night but their plant is still running at a material cost. An energy survey can try to find if there is a problem and the cause of the problem. For example, we might find:

A number of organisations were shocked to see their energy bills continue un-changed after they locked down. The cause turned out to be electricity meters not working. Their suppliers billed on estimated half-hourly data and did not flag this up on the bill. We needed to find the files of HH data which show if the data is “actual” or “estimated”? Once the problem was identified we had to negotiate more realistic bills while waiting for the ban on engineers visiting sites to be lifted.

A similar problem hit gas consumers. Their “AMR” meters are notoriously unreliable. Most empty sites had someone keeping an eye on them and they could take gas meter readings on their rounds and send them to their supplier.

Even though many businesses were closed, the energy suppliers expected bills to be paid and direct debits to be honoured. Customers may have struggled with cash-flow or the practicalities of paying bills after they furloughed their staff. In the end, suppliers focussed their staff on engaging with the customers to try to get an appropriate balance between collecting payments and helping their customers by extending payment terms.

As well as managing their cashflow the energy suppliers had to manage the volume of energy they had purchased. Clearly, they weren’t anticipating a once-in-century loss of customers’ volume and they had significant excess volumes of wholesale energy to sell back into a market where the prices subsequently collapsed. The suppliers looking into the small-print of their contracts and invoked their various different “take-or-pay”, “volume tolerance”, “reforecasting” and “cash-out” clauses to recover the cost from their customers. Some customers had favourable contacts and missed the penalties.

Finally, we saw 2020 echo the problems we saw 2008 and 2009. Suppliers and their credit insurers became very nervous and slow to respond. They didn’t know which business would fail during lock-down. Some suppliers simply stopped quoting for new business. Businesses which were suitable for credit insurance before lock-down lost their credit cover, even in sectors that were unaffected by the pandemic.

As businesses re-open, hopefully their energy buyers and energy managers are a better equipped to face the perennial challenges of negotiating the best contract with their suppliers and cutting their load to the absolute minimum.

Energy buyers can see that wholesale gas and electricity prices are still in the lower part of the range we have seen over the last 10+ years. If they feel confident in the volume of energy they require then it’s opportunity to buy.

Written by Beond’s Consulting and Risk Services Director, Mark Callaway