The UK’s Day-Ahead gas price fell last week, again to record lows since 2007, falling 14.3% to 12.30 p/therm.

Day-Ahead power saw a decrease of 11.8%, as the weather outlook improves, providing clear and stable weather for consistent renewable generation.

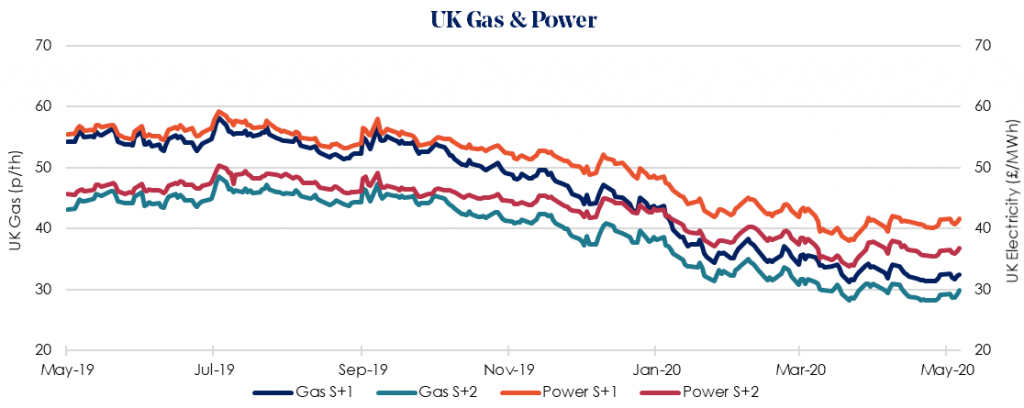

Winter 2020/21 gas remained neutral from last week with a small rise of 0.1% to 32.48 p/therm. The equivalent power price was also stable at 41.53 £/MWh.

Month-ahead gas prices continue to fall, as Continental maintenance works shutdown the ability to export into Europe. This led to a doubling of Norwegian gas supply to the UK, in place of Europe, causing an oversupply of 34 mcm/d.

Gas consumption is expected to reach the floor for the summer this week as warmer temperatures arrive in the UK. Three LNG deliveries from Qatar are scheduled to arrive at South Hook this week, keeping the UK gas system oversupplied.

Prices are still at 13-year lows with warmer, stable, temperatures compounding storage oversupply and ongoing demand limitations, because of COVID-19.

Despite the lockdown now lifting in many areas, the combination of economic recession and some indication of a second wave of COVID-19 drive the sentiment in the market, and are a sign that short-term prices may continue to drop.

Our recommendation is to lock in contracts before June 2020 ahead of expected long-term volatility due to economic slowdown.