The UK’s Day-Ahead gas price continued to fall, posting losses of 20.7% to 10.70 p/therm as the effects of Covid-19 continue to impact the UK wholesale market. Similar magnitude impacts are also being felt on near curves, with May 2020 prices tumbling 16.9% to 12.76 p/therm.

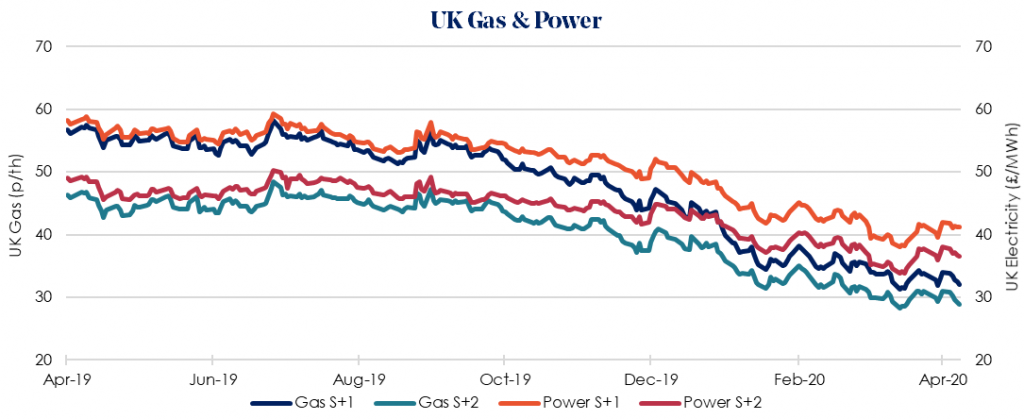

The Winter 2020/21 gas price slid 5.8% week-on-week to 32.06 p/therm, with the equivalent power price falling 2.0% to £41.21/MWh.

Pipeline gas flows from Norway to the UK continue to remain low. Flows to Britain were at 29 mcm/d on Friday, a small decline from 31 mcm/d last Friday, but down from 50 mcm/d in recent weeks.

The planned maintenance at Norway’s Oseberg gas processing plant, due to begin this week, has been postponed until late May with capacity set to rise to 20 mcm/d, revised up by 4 mcm/d.

Low prices continue to persist, with the front of the curve dictated by healthy supply and storage levels from reduced gas demand, paired with low oil prices.

LNG send-out from South Hook is expected to remain at around 40 to 45 mcm/d for the next 10 days as four Qatari cargoes are due at the terminal.

Seasonal contracts remain low and continue to fall. Sum-21 and Win-21 once again posted decreases across gas and power.

Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.