The UK’s Day-Ahead gas price fell by 8.8% to 13.50 p/therm as the UK wholesale market continues to feel the effects of the COVID-19 pandemic, paired with warmer weather forecasts. News that the UK lockdown has been extended by at least another 3 weeks means demand is expected to remain lower than normal. This is also impacting May 2020 prices, dropping 8.9%

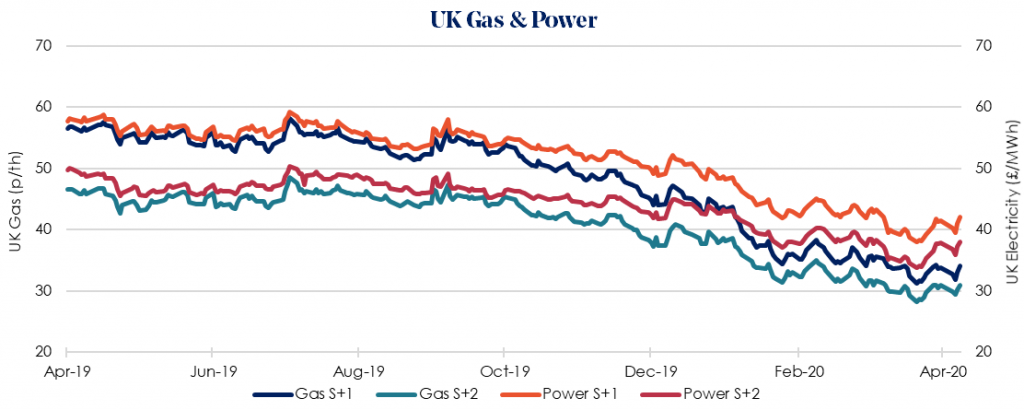

The Winter 2020/21 gas price remained flat, moving 0.5% week-on-week to 34.04 p/therm, with the equivalent power price rising 1.3% to £42.03/MWh. These small movements reflect the uncertainty around how long the impact of COVID-19 will be felt.

Pipeline gas flows from Norway to the UK continue to remain low, with flows to Britain at 31 mcm/d on Friday, down from 50 mcm/d in recent weeks. There is ongoing maintenance at Norway’s Karsto gas processing plant, expected to end in June, although the impact of this is relatively small at 6 mcm/d.

Sliding oil prices, paired with reduced demand for gas and record-high stocks, 25% higher than the average level at this time of year compared to the past five years, mean low prices persist. LNG send-out was noticeably higher at the end of last week compared to previous, with additional deliveries from Qatar expected on Tuesday and Wednesday.

Seasonal contracts remain low and continue to fall. Sum-21 and Win-21 once again posted decreases across gas and power. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.