The UK’s Day-Ahead gas price fell by 6.0% to 23.50 p/therm. This has been due to milder weather reducing heating consumption and an increase in LNG send-out.

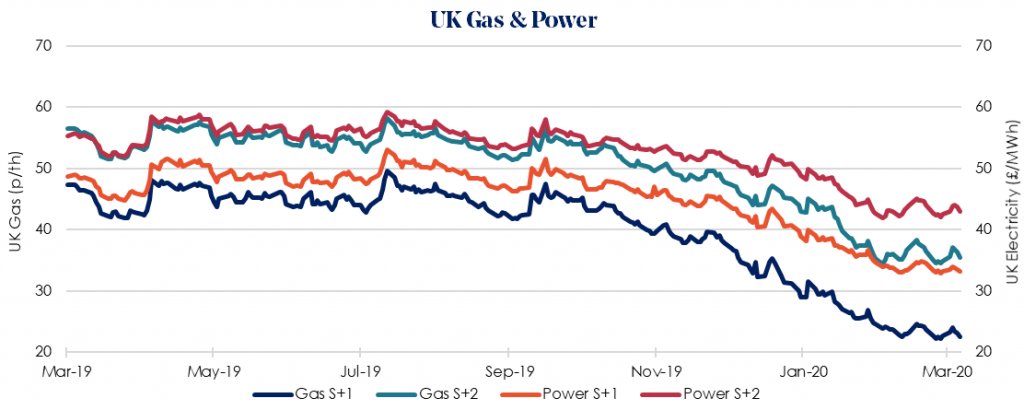

The Summer 2020 gas price fell very slightly by 0.4% week-on-week to 22.55 p/therm, with the equivalent power contract matching the trend in gas falling 0.1% to £33.20/MWh. Markets have moved broadly sideways due to the balance of bullish and bearish drivers largely offsetting one another.

Bullish drivers this week are mainly due to the market anticipating an increase in gas demand resulting from a drop in wind power generation, with gas for power consumption increasing by 16% to 81 mcm/d.

Bearish drivers appear to be much more tangible. Following drops in wind speeds, a queue of LNG cargos has begun supplying the network, with a further six LNG tankers set to complete regasification before the end of the week. Consumption is also set to decrease by 11 mcm/d responding to milder temperatures in the UK, all of which have marginally lowered both Day-Ahead and Summer 2020 gas prices.

On top of milder temperatures, northern UK wind speeds are expected to increase moving into next week. This is likely to see a movement back towards reducing gas for power generation, as wind generation improves, leading to net injections into gas storage at a rate of 20 mcm/d across the week.

Seasonal contracts have moved sideways, with Sum-20 and Win-20 remaining low. Sum-21 and Win-21 are relatively steady with marginal decreases across gas and power. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to coronavirus driven economic slowdown.